1. Basis for screening an opportunity![]()

2. Industry and Market

3. Economics

4. Harvest Issues

5. Competitive Advantage issues

6.Management team

7. Fatal Flaw Issues

8. Fatal Flaws of New Ventures

9. Opportunity Screen (example)

10. Rules

1.Basis for screening opportunities

The venture investment community screens opportunities constantly. They have a discipline that is seldom used inside corporations. You can learn from them.

• Industry and Markets

• Economics

• Harvest Issues

• Competitive Advantage

• Management Team

• Fatal Flaw

Rule: “You don’t have to be the best, just better than the competition”.

Your initial competition is for resources; money and people.

• You have competition at the investment level for capital; there are other opportunities to fund.

• You have competition at the “team” level; there are other teams to join.

Rule: “A top quality team, in a high growth industry, has a high chance of success”

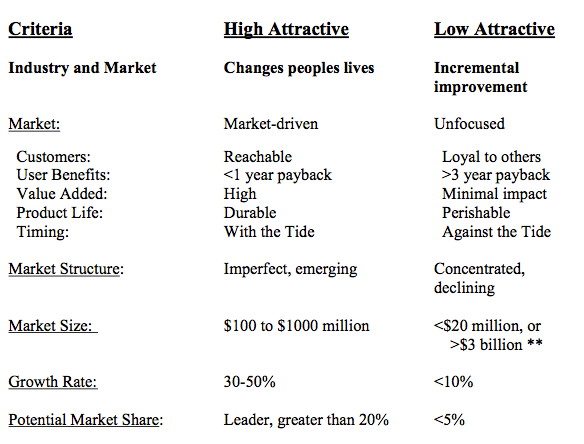

2.Industry and market

Rule: “Never stop assessing your market”

** The current capital markets have changed this somewhat, especially for Current Venture Backed “Valley” startups. We will discuss this in class.

*** Wow, did that change in a hurry.

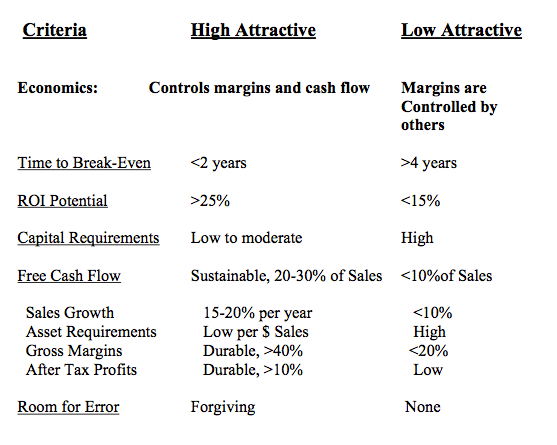

3.Economics

If you don’t understand something here, go to business school, or otherwise learn, until it is clear

Rule: “You need a real business model to build a real company with lasting value”

4.Harvest issues

For Publicly traded companies, the “harvest” may be in the eventual earnings and the reflected price of the companies’ stock

For non-public companies, the “harvest” may be the income stream.

For the start-up, the “harvest” may be a sale of the business to another company or to the public

MOST companies treat their businesses as a saleable asset.

Rule: “You have to have a way out. You can’t sell a job”

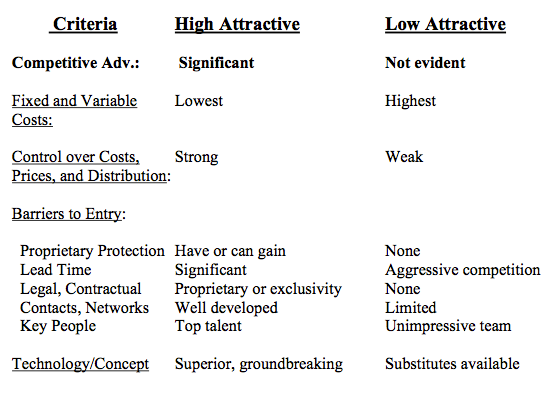

5.Competitive advantage issues

Rule: “Patents protect you from “Honest” people”

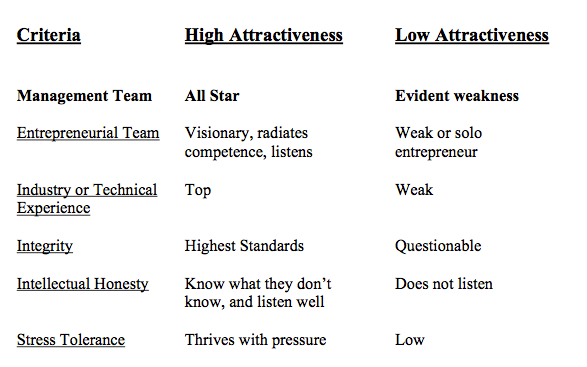

6.Management team

Rule: “The three most important things to a venture’s success are the team, the team, and the team”

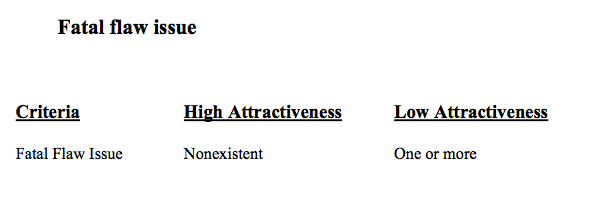

7.Fatal flaw issue

Rule: “Any Fatal flaw can kill a venture”

You must analyze your failures and develop a list of fatal flaws that are relevant to your organization and business.

Rule: “All successful Businesses are the same, all unsuccessful ones are different”

• Success: All factors are addressed

• Unsuccessful: Each with a different fatal flaw

8.Fatal Flaws of new Ventures:

(A representative list from previous sessions)

• No real customer

• Wrong corporate culture

• Inappropriate team (Unmotivated, wrong skills)

• Ignorant of market

• Arrogance

• Over engineering of product

• Failed to stress test properly

• Over promise – under deliver

• Poor sub suppliers or partners

• Trying to do too much

• Green team, no diversity

• “Family” in the business

• Wrong location

• Competition dropped their price, killed them

• Market window had closed

• Microsoft (or equal) in your space

• Authority to act not given to team

• Lack of focus of leaders and management

• Monarch or King syndrome

• Egos in the way (“I have to be CEO”)

• No consensus on team – no “buy-in”

• Not properly financed

• No sense of Urgency

• Hidden Liability

• _____________________________

• _____________________________

• _____________________________

• _____________________________

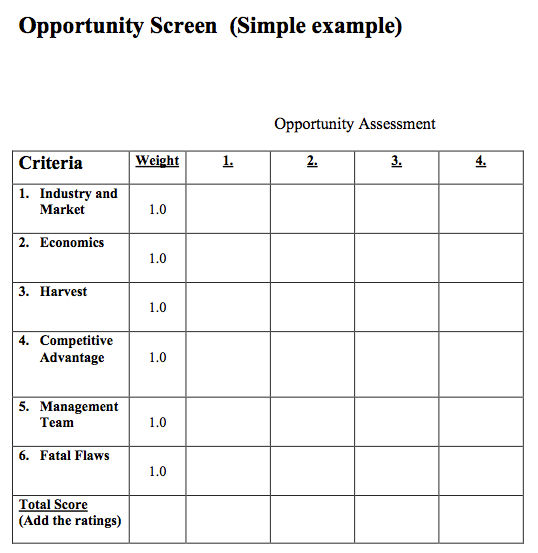

9.Opportunity Screen (Simple example)

10.Rule:

• You have to have multiple opportunities to make an assessment

Rules: Opportunity Recognition

• “Any fatal flaw can kill a venture”

• “Never stop assessing your market.”

• “The economics of the opportunity must be clear. You need a business model”

• “You don’t have to be the best, just better than the competition”

• “Your initial competition is for resources; money and people”

• “A top quality team, in a high growth industry, has a high chance of success”

• “You can’t sell a job.”

• “Patents protect you from “Honest” people”

• “ The three most important things are the team, the team, and the team”

• All opportunities are “relative”.