1. Big Picture: Fundamental Rules About Money![]()

2. Finding Money

3. Competing for Money

4. Asking for Money

5. GAAP

6. Money Cautions

7. Venture Capital

8. Wisdom from a Venture Capitalist

9. Rules

1.Big Picture: Fundamental rule about money:

The Golden Rule of Money: “He who has the gold, rules.”

An investor usually feels strongly attached to his money, and parts with it reluctantly. His concerns are return vs. risk. Managing one’s risk is why investors are likely to want control.

What are the differences in the objectives of an investment by a Venture Capitalist in a startup, and an investment by a company in an internal project?

2.Finding Money:

Sources of funding (in order of usual use by a business). For the Intrepreneur, your company may act in one or many of these capacities.

1. Friends and Family (The 3 F’s): Very early stage. May finance you because they like you, or would have to support you anyhow.

2. Angels Investors: Rich guys who have an interest in you, or in your product.

3. Venture Capital: For when you get serious. However, these guys are in it for the return. Don’t bother them if you don’t plan to get big.

4. Public Markets: Going Public. Raise a lot of cash, and provide liquidity for the early investors. (An “exit strategy”)

5. Corporate Partners: Joint Ventures. Their success rate is poor. Selling to a corporation is also a good exit strategy. Usually these are customers or competitors.

6. Banks and Lending Institutions: Ready to give you money when you don’t need it. Used by large, secure companies. Sometimes, you can get debt with a “guarantee”.

7. Leverage: Using debt to buy back ownership from the public. Usually done to enrich the management.

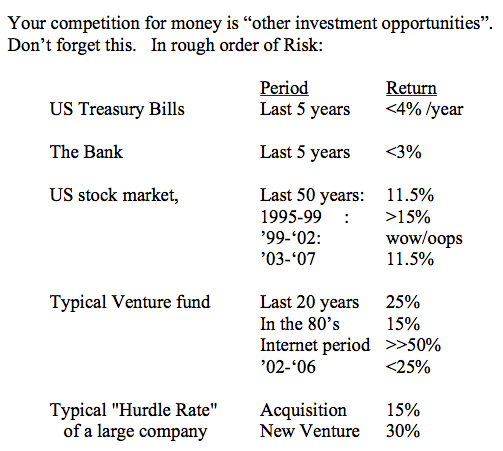

3.Competing for Money

In most organizations,

• There are more interesting opportunities for development, than there is money to do them.

• There are more interesting projects to join, than people to do the work.

You have to compete for resources (People and Money) against other sharp intrepreneurs. The most competitive usually wins.

Competition can include such metrics as:

• Return on investment

• Risk adjusted returns

• Economic Value Added

• Synergy with other product lines

• (cost of cannibalizing existing products)

• Others

Know what these mean, and what the benchmarks are for each in your organization

Competition can also include “soft issues”, as:

• How “cool” the project is

• How much the decision makers like you

• “Strategic” issues (used to justify really bad investments)

• What’s in it for the decision makers

Rule: “Be aware you are competing at all times. Someone somewhere is trying to eat your lunch”.

4.Asking for Money:

You absolutely must have a budget for your project. This must be in writing, and signed off by all the important decision-makers. If you do not have a signed budget that is adequate, you do not have a project.

Always ask for more than you think you need.

• Managers in large corporations figure this out quickly

• Most Entrepreneurs ask for too little

When you get it, spend according to your plan.

• If you spend too much, you get in trouble

• If you spend too little, you miss your opportunity

Rules:

• “Raise money when you don’t need it.”

• “Raise more than you need”

• “Make sure you understand fully your “deal”, and are absolutely happy with it. Get it in writing.”

If you wait too long to raise money, and get caught short, the power moves to the money source. You will “get stuffed” badly. If you don’t raise enough, the market can change.

Most established businesses pretend to make decisions using financial analysis. The language is usually GAAP.

Rules:

• Know your company’s process for financial decision making

• Speak the relevant accounting language fluently

• If you do not speak the language of money, you are not involved in the decision process.

5.GAAP

“Generally Accepted Accounting Principles”

Accounting is simply a “power balance” in a medium. The first financial calculator was a water flow calculator. (You can see it in the British Museum)\

There are 3 parts:

1. What is the money flow into and out of my “bucket” from the operating business?

2. How much of what is in my bucket at a particular time do I really own?

3. If I choose to add or remove money to the system, (other than from the business operations) where did it come from, or where did it go?

The 3 parts of a Financial Statement are:

1. Income Statement: (Money flow from operations over a period of time)

2. Balance Sheet: (What I own and owe at a particular time)

3. Sources and Uses of Cash: (Where is the money going) Start by doing this for your personal finances. Keep it simple.

6.Money Cautions:

1. Money is a (very powerful and very bad) drug. Be very careful about having it around.

a. Too much money can kill a venture

b. Too little money, and you spend all your time trying to get more

2. Money is a poor motivator of people

a. Too much kills motivation

b. People don’t work for money. (It is, however, a very big “stroke”, and a measure of success)

c. People’s happiness is proportional only to the rate of change of wealth.

3. Avoid the trappings of money

a. Toys distract you

b. Everyone involved in your venture (investors, partners, employees) wants you to struggle.

c. Wait until you exit to go play.

4. No Budget => No Project

a. Never accept a project without an appropriate budget

7.Venture Capital:

This is the usual source of significant money at some point in a venture’s life. You should understand these guys thoroughly.

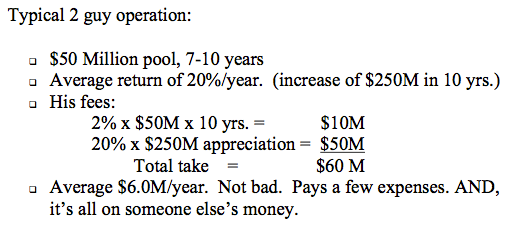

How a VC makes money:

• Puts together a pool from rich guys, pension funds, etc

• Invests the pool in various “high risk” businesses

• Takes a fee of 2% of the pool for “expenses” each year

• Takes 20% of the increase in value of the investments, when they are liquidated.

Some of his interests are aligned with yours.

• He wants you to succeed

• He wants a way to get his money out, or he won’t get paid!

• He is not in the business of keeping you employed

8.Wisdom from a Venture Capitalist:

• There is (still) more money available than good opportunities.

• It’s (still) a great time to be an Entrepreneur

• Be careful to know the philosophy of the VC you approach. You do not get too many chances to shop around. It is a very small community.

• A VC’s objective is to make money. Typically, he expects to do “better than” the overall stock market. Allowing for the failures, the typical objective of a VC investment is a return of 40% per year.

• You have to have a clear exit strategy. A VC must have a plan to get his money out. (His investors expect it)

• A VC invests in 1/50 to 1/100 of the business plans he sees.

o Of his investments, 50% are into businesses that came via a “referral”

o Referrals account for about 1/10th of the plans he sees

o Therefore, work your network.

o “Plans dropped over the wall have a very low chance of being funded” (about 0.5%, vs. 5% for referrals)

• Learn Sales and marketing! Getting funded is a “sales and marketing” job.

• Use a lawyer who knows Venture Funding, and who is respected by the VC community.

• A VC makes money by having your business be successful. Use him.

9.Rules:

• He who has the gold, rules

• You are competing for money, be competitive

• When you get money, spend according to your plan

• Speak the language of money fluently

• If you don’t know Finance, you are not a decision maker in your organization

• Money is a drug. Use it with extreme caution

• Raise money only when you don’t need it

• Raise more than you need, if you can

• No budget = No project