On the pages following are 4 case studies and exercises![]()

1. Business Opportunity: “Life’s a Beach”

2.Business Opportunity: “Tuna Tail”

3. Business Opportunity: “Robo-Boat”

4. Business opportunity: “Oceans.com”

5. Exercise: “Come sail with me”

As you will probably notice, these are “Ocean Related” cases. This is not an accident.

We would like to acknowledge once again and thank the MIT Sea Grant College Program, and the Department of Ocean Engineering, for their sponsorship and support of this program.

The cases following are typical of the result of the “first phase” of the entrepreneurial process. Your role would be that of a potential founding team member, a potential Angel Investor, or simply a business advisor. The exercise is to evaluate each opportunity from several perspectives:

• Is it a real opportunity?

• Is it attractive as a business?

• Is it attractive to you to join or invest?

• Are there any significant fatal flaws with the business?

• What is your advice to the entrepreneur?

1.Business Opportunity: “Life’s a Beach”

Background:

I met Jack in Woods Hole on Saturday of Labor Day weekend. Jack was sitting behind a cart inside the mouth of a “Carchacodon Megalodon”, a replica of an extinct shark (the ancestor of the Great White Shark.) Hung on the teeth was an array of shark tooth necklaces, priced from $5 to $20 (avg. $10). Foot traffic was very light; it was not a great day. However, EVERY boy, ages 4-14 who passed by stopped and looked. Of those with their parents, half bought. By 5 PM, Jack had sold over $1000 worth of necklaces. I personally sold over $400 worth of necklaces for him from 1 PM to 5 PM.

Jack is a 56 yr. old guy, who just happens to love sharks. He made the Jaw last year, because he thought people would pay to have their picture taken (they wouldn’t). Last winter, he bought 100 pounds of sharks’ teeth, and subcontracted the necklaces on a piecework basis (they cost him $.50 to $1.30). He has been testing the concept all summer, and has grossed $70,000 in about 100 days (pre tax, but this is a cash business). He has a peddler’s license, and trucks his opportunity to various festivals and fairs on the Cape, when they happen. If there is no fair, he goes to the beach. In addition to selling the necklaces, he gives away a poster of extinct sharks to any kid, who buys, (and sometimes to those that don’t buy).

He is divorced, single, and enjoys being at the beach. The job is fairly lonely, but he often gets company (like me) for extended periods of time, because, if you don’t have to do it full time, selling to small boys is actually a lot of fun.

The week following Labor Day, Jack was going to the scallop festival in Bourne, and then leaving for Florida for the winter, where he will continue to check out the concept, and figure out what to do next.

What to do next:

Jack sees several choices. One, he can continue to work the beach and make a reasonable living as essentially a craft. He figures he could figure out the formula, work half time, and make over $100,000 per year. The booth is portable; he can go anywhere and have a pretty good time. Alternately, Jack could

• hire someone else to sell for him.

• he could license or franchise.

• sell carts, and supply the necklaces from the piecework sources

• he could become a “Shark Pushcart” at Malls, with T shirt, books, and other stuff.

Some Background:

1. Market

The market for these necklaces is clearly hot right now. You can actually buy kits to make your own (teeth not supplied). There is no telling how long this fad would last. However, small boys have always been fascinated with sharks.

There are probably 100-200 beach territories in the US where one could make a reasonable living doing the beach and festival thing (e.g. Cape Cod, NJ beaches, Long Island beaches, Myrtle Beach, Daytona, Miami, etc, etc.). If you add the rest of the world (San Tropez, Greece, Turkey, Bahamas, Virgin Islands,…..), you might get thousands.

There are 2000 – 3000 malls in the US, which have a structure that would support a pushcart, or a small store. About 10% of these are in high tourist locations (i.e. a changing clientele) vs. a stable clientele.

2. Product

Jack can buy sharks teeth in 100 lb. Bags. Supply is no problem; Teeth are mined from ocean sand, and are used in the jewelry industry already. Having the necklaces made is also no problem. He purchases the necklaces from a number of piece-work suppliers at an average cost of $1.00 each. If Jack’s volume was higher, he could reduce his cost by >25% with little problem.

Finding other products to expand the offerings to a “cart” or a small store is also not a problem. Products and suppliers are readily available; Jack is really just providing a new retail vehicle for these products.

3. Pricing

Jack sells the necklaces for $20 to $5. His average sale is $10. There is resistance to a higher price, at least on the beach.

4. Competition

Jewelry stores already sell these necklaces, but at much higher prices. The Nature Company and similar stores sell Shark stuff. However, on the beach, there is little competition for trinkets for small boys.

5. Barrier to entry

There is little to stop a competitor from doing the same thing. The concept is not a high investment (the Jaw with cart cost Jack $18,000 to make. He can make copies for roughly $5,000).

6. Jack’s background

Prior to this, Jack was in the “afterlife revitalization business”. He worked as a turn-around specialist for a large ($7B/yr) Swiss company which purchases bankrupt cemeteries, and turns them back into money making businesses. Jack has traveled the world doing this, and has a very successful track record delivering results (getting the “stiffs” out, as Jack puts it). Jack is honest, listens well, and is a very likable guy.

Jack has enlisted some help to work on this. He has a potential partner who has retired early from his role as head of purchasing at a retail chain. Jack feels that this partner could handle the supply, subcontracting and financial side of the business, leaving him with sales and operations. Jack and his partner have elected the option of leasing the carts, and supplying the necklaces, and produced a brief business plan outlining this approach. They figure that they will need an investment of $100,000 to get the business off the ground, and profitable. They predict +2 year sales of $1,000,000, with pre-tax profits of $450,000.

7. Jack has approached you and asked you to if you would

• Give him advice as to which path to take

• Join his team to make this happen, or

• Invest in the opportunity

In your group, discuss the opportunity, and try to answer each of the above questions. Try to decide what the opportunity would have to look like to be attractive to invest or join. (i.e. what is your ownership for your $100k). Have one person prepare to report out.

2.Business Opportunity: “Tuna Tail”

Background:

George is an assistant professor of Ocean Engineering at a Prestigious University in the USA. George has been working a part of a team, which has discovered that fish tails are significantly better as propulsion mechanisms than conventional screw propellers. Roughly, an arrangement of “flapping rudders” instead of propellers could potentially increase propulsion efficiency by 30%. Since this could translate directly to fuel savings, and since fuel is a BIG cost of operating a ship, this could have a major impact on the industry. George’s background is primarily mechanical. His team leader (a full professor) does the hydro. George is fairly personable, and has developed a good relationship with the Government sponsor of this research.

To put this in perspective, a moderately sized ship (50,000 DWT) uses roughly $40,000,000 of fuel in its 20-year life. The power plant costs roughly $5,000,000 installed, of which $3.5M is engines and gears, and $1.5M is propeller and shafting. If one could use the flapping rudders instead, the first cost of the total power plant would likely increase by 15% (hull stiffening, special mechanisms, less reduced engine costs from lower power), but this would be more than offset by the fuel savings.

George has been developing the mechanisms necessary to bring this invention from a “concept’ to a workable prototype for several years. Funding continues to be provided by the Government. With the help of graduate students, George has constructed a 20 foot boat, verified the performance gains, and developed a workable flapper mechanism that can propel this model (7 HP) around the harbor. This model provided an interesting new discovery; the rudder mechanism makes the vessel VERY maneuverable. It can “turn on a dime” when required. Full power thrust reversals are essentially instantaneous. The biggest uncertainty is related to the “low torque” required by the mechanism (which can put huge forces on the vessel structure), and the potential reliability questions.

George’s background:

George is a mechanical engineer, with a Ph.D. from PU, and an undergraduate degree from Grecian U. George is 38, and has been in the USA since starting graduate school, and has never left P.U., except for occasional consulting contracts.

George’s father was in the shipping business as a moderate (by Greek standards) fleet operator in Greece, (retired since 5 years), and George has quite a few contacts in the shipping business, both personally in the USA, and through his father elsewhere in the world. George’s father is very wealthy, widowed, and lonely. He would like to see more of his son and grandchildren. George is married, has 2 children, ages 10,12. George’s wife (of Greek ancestry) is not happy with the lifestyle that George provides, and doesn’t hesitate to tell him this. George’s wife has her own career, and is unwilling to leave the US.

George is a quiet guy, careful in his analyses, and quite happy in the lab. George works over 70 hours a week, mostly because he likes the technology, and going home is not an attractive alternative. George is able to work well with small teams of students. He has little experience in running large programs.

What to do next:

George sees several choices:

1. The easiest course would be to license the technology. As part of the development team, George’s agreement with PU would give him (and the others on the team) a small share of any cash received (roughly 5% each). However, George is at a loss as to where or to whom to license this technology. The US doesn’t really build any ships any more. The propeller manufacturers in the US have a vested interest in their existing technology and manufacturing techniques. The Greek industry is primarily “owner Operators”, who simply order ships from the major builders. The major shipbuilders are located in Korea, Spain, and China. George is worried that his patents would be simply violated, possibly even by the licensee, since the concept is not difficult to understand, could be built by a yard, and the use would be difficult to detect. Even if he could detect, how would he enforce the patents, sue a Korean company in Korea? What about the travel? His wife is not happy about him traveling.

2. George could take a license from PU, start “Propulsion Company, Inc”, and manufacture the “linkage mechanisms”. Since there would be some significant “Know-how” in this part of the mechanism, this could be a potential business, not unlike a reduction gear manufacturer. The yards could build the rudders, and buy the linkage. He could locate the company in Greece, and use his connections through his father to get started. His father could supply both customers and a team to get the business started. His wife, though, would not be happy moving to Greece.

3. George could ignore the “big ship” market, and concentrate on the pleasure vehicle market. George sees potential in using this propulsion mechanism for underwater dive sleds, Autonomous Underwater Vehicles (AUV’s), fishing boats, even pleasure craft. George sees these markets as much larger, but doesn’t have a lot of contacts, since most of his research has been government and large commercial vessels. This market is not as sensitive to fuel costs, but perhaps the maneuverability would be attractive. Again, he could license, or produce. This would be a US activity, so his family issues would be more manageable.

Some Background:

1. Market

There are roughly 500 ships built each year, worldwide. Of these, approximately 300 are high fuel consumption vessels, where the cost benefits of George’s invention would be attractive. 90% of these ships are built outside of the US. The customers for these ships are large, foreign based owner-operator companies; roughly 20 companies make up most of the market. The overall worldwide market is stable, although the US market continues to decline

2. Product

From George’s perspective, the product is primarily the know-how of the mechanism and how to make it. This is not rocket science. The mechanism involves VERY large castings, big bearings, and a lot of structural junk. Thank God for FEA analyses, or this part would be impossible to figure out. There is the problem of how to actually make the mechanism, but George figures he can contract pieces locally in country where the yard is located (like the large A&E firm, Bechtell operates).

If George were to license this technology instead of making it, the school might get a license fee of 2% of the cost of the mechanisms. George’s concerns with

licensing are that the licensee might not actually push the technology, so his share would be 0.4% of nothing. On the up side this could still be quite respectable relative to his professor’s salary, and it would keep him at home.

3. Pricing and financials

The difference between the additional costs of the mechanism ($1.5M), and the 20 year fuel savings ($10M), could potentially allow George to price the product higher, and make a better profit. George’s initial business plan showed that if he could price the mechanism at $1.5M over the conventional system, and could capture 50% of the market in 10 years, he could provide a reasonable return on the investment in the business (about 30%/year) – Higher prices, greater return.

Typical costs per ship would be $5,5M each. 10 year sales (with 50% of the market) could be $800M/yr. The initial investment would be high (about $20M), but George estimates that the business would break even at the 5 ship per year level.

4. Competition

George sees the competition as the propeller manufacturers (e.g. Bird Johnson), the yards themselves (hey, how tough is this), the shafting manufacturers. He perceives that the system will still need shafting, and the yards would rather outsource this, so long as the components are locally made.

The real looser would be the propeller companies, who have good relationships with the yards today, and would be likely to attack him on the “reliability” issue. Of course, they might be willing to license. George’s concerns with licensing are especially severe with them propeller companies, they might “put it on the shelf”. Of course, he could insist on a large up-front payment.

5. Barrier to entry

George and his team have already filed several patents. The US patent on the fundamental technology just issued, and the other world patents are underway. PU is taking care of the patent filings, but from cost considerations, has filed only in the US, Europe, and Japan.

6. George has approached you and asked you to if you would

• Give him advice as to which path to take Entrepreneurship and

• Join his team to make this happen, or

• Invest in the opportunity

In your group, discuss the opportunity, and try to answer each of the above questions. Try to decide what the opportunity would have to look like to be attractive to invest or join (i.e. what is your ownership for your $100k). Have one person prepare to report out.

3.Business Opportunity: “Robo-Boat”

Background:

Pete is a recent MIT graduate, working in the Sea Grant lab. Pete has been working on a Government program to develop an “Autonomous Underwater Vehicle” (AUV); basically a remotely controlled a torpedo which can go out on it’s own, make measurements, and transmit the information accurately to shore. This has been made possible by the explosion of cellular phone, sensor, and computer technology.

Pete has been leading a team of 5-7 developers, including grad students and full time staff. They have developed a prototype vessel that fulfills all of the mission requirements; i.e. survey the depths of the ocean, map the data, and update a chart. The mission, as envisioned by the government sponsor, would be to have a fleet of these available, which would accompany a master vessel, and conduct surveys. Because one vessel can handle 20-30 of these, the ability to collect data cheaply and efficiently is much improved, over a single vessel. (Today’s technology is to tow a sensor on the end of a LONG line, in order to get the sensor close enough to the bottom to see accurately). Pete’s team has solved all of the critical technical problems, although the reliability of the system needs work.

The government sponsor is very interested in helping the team commercialize a venture that would provide information to update hydrographic charts, (which are very out of date and expensive to collect the data to update). The government has an ongoing program, and runs ships, but this is very expensive, and the data collection rate (especially for harbors) is slow. The backlog (charts that need updating) represents about 40 years of effort of the current Gov’t fleet.

Separately, Pete has been approached by possible customers in the fiber-optic cable laying business. They see a huge advantage in using these vehicles to survey in front of cables. (Laying a cable over a sharp rock can be a Huge mistake). One customer has ordered a prototype from SeaGrant for $1.5M, which Pete is making. Pete has received interest from the US Marines, who want cheap versions to hunt and deactivate mines.

The project is nearing completion, and Pete is trying to decide what to do next. He could move on to the next program, or try to do something with this concept commercially. His team members have told him that they would leave MIT to join a startup with him, and he has the support of the department head to take them and give it a try.

What to do next:

Pete sees several opportunities for the AUV. He could build and sell “turnkey” vessels to customers, such as the government, who would then operate the vessels. He could build and lease the vessels. Alternately, he could build a few systems and operate a “service” company to collect and sell the data.

Some Background:

1. Market: The US government, (NOAA, Army Core of Engineers) are the primary users of the hydrographic information. These 2 agencies spend about $100M per year on surveys, primarily on their own vehicles and crews. Pete thinks he could get 30% to 50% of this market, by providing a product or service that is 10x as efficient. In addition, there are a lot of foreign opportunities (e.g. the Bahamas) where data is badly needed, although Pete is unsure about whether other governments would buy/contract from a US company.

2. Product: The 2 possible products are:

a. a vessel costing about $0.7-1.0M each, which would be instrumented, and sold as a system. Pete estimates that a typical sale would be 10 vessels plus a home base, for about $15M. He thinks the US agencies would purchase 10 systems over a 5 year period. His commercial customers have promised to buy 3 per year, if the prototype is successful. Pete expects a total 10 per year possible would be possible with the cable industry.

b. A service business of competing for contracts for data. Since the entrenched competition is “in-house”, Pete is unsure as to how much he could get. His Gov’t customer, though, has assured him one starting contract. His customer has suggested that they work together to get a contract to Pete, and has hinted that if he could get this, he (the customer) would like to come join the company. (Maybe Pete could buy the vessels from the government).

3. Pricing: The vessels could cost about $500,000 each to make. The pricing of the data collection and sale business is less clear. This would be a new process for the government procurement, so benchmarks are not there.

4. Competition: There is some small competition in the AUV business, primarily from other universities. Current competitors for the data are survey vessels, manned with 20-30 persons, whose rate of data collection is 1/10th of the ASC. These competitor vessels typically cost $10,000 per day. The downside is that they are “already” purchased, have Gov’t crews, and the agency may have to pay for them whether they use them or not.

5. Financing: Pete figures that this business does not need a lot of capital, maybe only enough to build 2 units, and to keep a team going for a year, until they make their first sale. Unfortunately, he is broke, doesn’t know anyone with money, and will probably have to go to a VC to get funding. Depending on his plan, though, he may need a lot of money to build the vessels for lease or operation.

6. Barrier to entry: There is little barrier to entry. All the technology is “off- the –shelf” in 1997. It is unclear, though, if the Agencies themselves could put together a credible competition. Other commercial ventures could compete. Also, quasi – agencies, like Wood’s Hole, could get in the game, and use their better contacts to compete.

7. Pete’s background and team: Pete is a “broadband” technical guy, able to operate comfortably with the electronic, mechanical, and operational technologies. Pete is 25 yrs. old, single, and a feeling a bit unfocused in his life. He has no social life to speak of, but hey, he goes to MIT, what would you expect. His team at the Lab is mostly technical, so he would need someone to handle the selling and business issues.

8. Pete has approached you and asked you to if you would

• Give him advice as to which path to take

• Join his team to make this happen, or

• Invest in the opportunity

In your group, discuss the opportunity, and try to answer each of the above questions. Try to decide what the opportunity would have to look like to be

attractive to invest or join. (i.e. what is your ownership for your $100k). Have one person prepare to report out.

4.Business Opportunity: “Oceans.com”

Background:

Sam also works in the MIT Sea Grant Lab, where he has been in charge of Information Technology for the last 5 years. He has been the architect of much of the lab’s computer systems, as well as the systems that have been to sea on Pete’s projects. He has developed a satellite/internet-based system for collecting data remotely, and shipping it back to the lab in real time. (Sam gets seasick easily, so will do anything to avoid going to sea).

Sea Grant has a contract with the government to develop an “ocean learning” web site, which would organize much of the ocean data which is collected by various organizations around the world. Sam has been the project leader for this project, which has been going quite well. The site is up, well organized, easy to search, and easy for other research organizations to put up information without loosing the functionality. The site has become a resource for researchers, and is becoming popular with the public as well. (Their dolphin video downloads are particularly popular). They are currently getting 30,000 hits per day on the site.

During the development of this site, Sam noticed that the commercial information relating to the oceans is extremely fragmented. Possibilities such as buying fish, chartering commercial vessels, buying marine parts, auctioning surplus marine parts, etc are available, but in a very fragmented and hap-hazard fashion. There are numerous sites popping up which are attempting to deal with pleasure craft issues, (e.g. boats.com, cyber-marine.com, iwaterways.com, etc). These are focused on supplying the pleasure boater with information and spare parts. However, the commercial area appears poorly done, and generally neglected.

Sam thinks he could develop an “Ocean portal”, which would both be an information resource, and well as a way to rationalize the flood of sites relating to the Oceans. There are business models developed for many of the possibilities (such as auctions, advertising, and “click-thru” referral fees), so he could partner for technology. He has discussed the idea with his Government sponsor, who thinks it is a terrific idea; i.e. the public market would help fund the development and maintenance of the ocean information, taking it off the list for Gov’t. support. The sponsor would license the existing effort to Sam, to form a base for the site, if he can get funded. The domain name “oceans.com” has been taken, but is owned by a resale shop, so it is available for a price.

MIT has agreed to help him get programming resources to get started, in return for a piece of equity.

What to do next:

Sam feels he has adequate support for the concept from MIT and his Government sponsor, but is clueless about how to get this started, and what a reasonable business model would be, or how to build a team to make this happen. He feels that there is a window of opportunity for the concept, but that it will slam shut quickly. He also doesn’t know if anyone else is already working on this portal idea, or how he would find out.

He feels that a business plan is needed, and has done some research into the opportunity (see below). He feels that if he can get a good plan together, he could get venture financing (in this current market), but has to act quickly. He badly needs team members and a sensibility check on the business plan.

Some Background:

1. Market: There are about 0.5 Million people in the USA who are involved in ocean related activities professionally, and a much larger number (approx. 30M) who have a large interest in then oceans. Worldwide, this is a much larger number, probably by a factor of 10 in countries with Internet capabilities. The ocean related business in the US is approximately $10B per year, and $200B worldwide. This is roughly divided into 4 groups; fisheries, transportation, pleasure, and undersea (oil and telecom).

2. Market Structure: Sam sees the opportunity lying in taking a small piece of the sales commission from the commercial side of the Ocean related industries. He sees that most of this brokerage will move to the web over time. Today’s major market segments are primarily: Fish purchasing ($20B in US alone), ship leasing ($10B worldwide), auction or sale of used ships and equipment ($2B), Undersea services (telecom and oil related) ($2B), licensing proprietary undersea information ($1.0B) and sale/construction of new vessels and equipment ($10 B). Typical brokerage commissions vary from 0.5% for shipping to 20% for sale of proprietary information. Sam estimates that he could get a “click thru” referral payment of about 5% of the commission.

3. Product: Sam sees a portal which would organize and search the various ocean-related information. Products would include advertising revenue, and commissions on click-through on ship leasing, purchase of proprietary undersea information, auctioning of property, and just linkage to pleasure boat commercial sites. Sam also sees the possibility to take over certain brokerage opportunities. Proprietary undersea information, for example, is a very fragmented industry, ripe for rationalization. However, Sam feels that initially, getting a referral fee from other e-sites would be sufficient. He would focus on making the portal compelling and easy to use, with lots of interesting information.

4. Technology and business model: The Internet boom means that there are many OEM providers of auction services, online commerce, online communities, search engines, etc. The technology to follow click-thru referrals exists, and some e-businesses have a model where they are paid for customers who come thru their portal site. (However, this is not widespread as a business model yet). Another business model is to have e-sites pay for prime space on the portal. This is a well established model.

5. Competition: Sam knows of no competition in the ocean “portal” business.. However, this does not mean that there is no one actively working in this space.

6. Financing: Sam estimates that he will need a team of 10 programmers to keep the site current, and 10 business development “feet on the street” to cut deals. His initial burn rate should be $4.0 M per year. He predicts a breakeven at 18 months after launch. Total, he figures he will need $5M investment.

7. Barrier to entry: Unfortunately, the barrier to entry is low. Anyone else can enter the market, and do the same thing. Sam expects to use contractual relationships to sew up the market. However, he has no experience making these type deals, and doesn’t know if the current brokers will cooperate.

8. Sam’s background and team: Sam has access to a large number of programmers, through the MIT Computer Labs. He feels he can drive the business, but will need to find help in Business Development. He has no startup experience. He has been approached by a group of MBA students from Sloan (the business school at MIT), who are interested in working on this. One of the these students’ father is a partner at Advent International (A very large Venture and Private Equity firm).

9. Sam has approached you and asked you to if you would

• Join his team to make this happen

• Invest in the opportunity

• Give him advise about what to do

In your group, discuss the opportunity, and try to answer each of the above questions. Try to decide what the opportunity would have to look like to be attractive to invest or join. (i.e. what is your ownership for your $100k). Have one person prepare to report out.

Evaluation of Case Studies.

Homework

Read the 4 cases. Determine if each opportunity is “attractive”, or what would have to change to make it attractive.

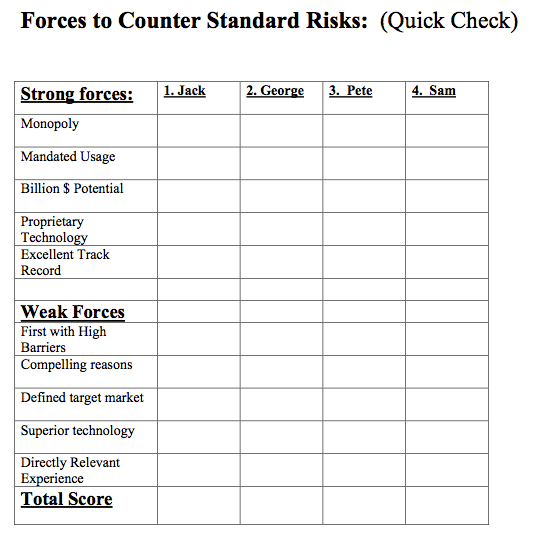

Use the “strong and weak force” evaluation sheet to help figure out how to make each opportunity attractive.

Be prepared to discuss in class.

Forces to Counter Standard Risks: (Quick Check)

Put a 2.0 in any Strong Force, 1.0 for any weak force. If not there, give a 0.

If total < 4.0, reject the opportunity, or figure out how to modify the opportunity to get 4 points.

5.Leadership Exercise: “Come Sail with Me”

1n 1491, Columbus was a student at GIT (Genoa Institute of Technology), working on calibrating a telescope. The purpose was to determine if he could predict the arrival times of ships, by measuring their size in the viewfinder. (so they could get all the wagons and donkeys scheduled efficiently). Needless to say, he discovered that he could not see “the whole ship”. He hypothesized a “non-flat earth”, and in fact was able to use the arrival times of these ships to estimate the diameter of the earth fairly accurately. (he was off by a factor of 2).

Unfortunately, it was heretical to mention this publicly, and at that time everyone else thought the earth had an edge, over which you could sail, if you went too far. Columbus, nevertheless, decided to try to get funding to take an expedition to India by sailing west, not east like everyone else.

He was, of course, turned down by every Venture Capitalist in Italy and most of the rest of Europe. Eventually, he managed to convince the Queen of Spain to privately fund the voyage. (Who knows what he had to do to get this funding)? Eventually, he had to get a crew.

Please write for Columbus the speech that he must give to this roomful of sailors to get them to come on board with him, (to almost certain death). One page, two max.